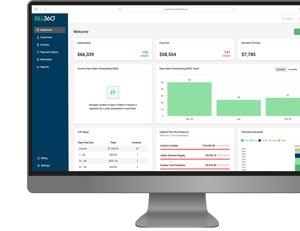

Maximize cash flow and give your customers a better experience.

B2B Payments

Automation

Portal

Insights

Get paid faster and eliminate check fraud.

Streamline your accounting and eliminate the risk of check fraud through our secure, all-in-one platform. Accept all forms of digital payments and process invoice payments, while setting card threshold amounts for each invoice and/or customers, saving you thousands on swipe fees.

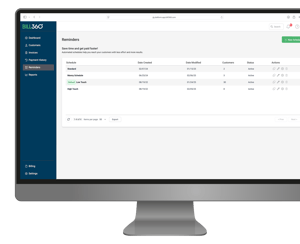

Let automations handle the heavy lifting.

Focus on running your business while our innovative AR automation platform generates electronic invoices with downloadable PDFs and embedded Pay Now links, while automatically reconciling payments.

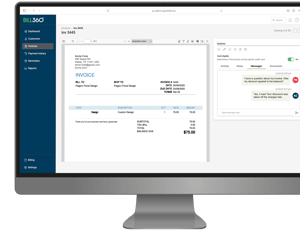

Convenience that keeps customers engaged.

Strengthen the buyer-seller relationship through a real-time communication portal where you can resolve discrepancies, respond to feedback, and provide immediate support, as well as create workflows that send automatic payment reminders.

Ditch the paper and go digital.

Send, track, and reconcile invoices in one secure platform that syncs with your accounting system and gets you paid faster than ever.

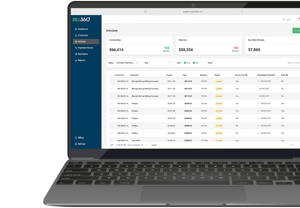

Real-time insights for smart decision making.

Make fast, well-informed business decisions with real-time updates on crucial metrics like Days Sales Outstanding (DSO), AR aging, and invoice statuses.

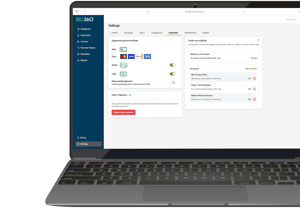

Customers can make a single payment without using a digital wallet.

Enable card payments, then set threshold amounts for each invoice and/or customer.

QuickBooks Online® parent customers can pay all sub-customers with one transaction.

Manage payment methods, set limits, and eliminate late payments with AutoPay.

Your customers can save a PDF of an invoice directly from email reminders.

NEW FEATURE

Your customers can make an immediate payment from a digital invoice.

See if and when your customers are looking at the digital invoices you send.

NEW FEATURE

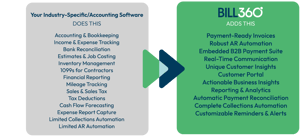

Take your accounting software to the next level.

Bill360 makes it easy to experience the benefits of accounts receivable automation. Our platform syncs to your current accounting system in minutes and enhances it with proprietary features and functionality.